In 1953, A.M. Barrett Jr., owner of Barrett Electronics launched the “Guide-O-Matic,” a modified towing tractor reconfigured to follow an overhead wire in a grocery warehouse. He didn’t call it an AGV, but he’s still credited with inventing the first Automatic Guided Vehicle. Soon after, he installed wires in the floor for this “Driverless Vehicle” to follow. And though radical strides have been made since, modern AGVs still follow this same principle: aid workers in moving goods around a work space.

News spread fast about this Driverless Vehicle (well, as fast as it could spread in the 1950s). The technology appealed to factory owners looking to streamline their manufacturing processes. The first internationally-known company to adopt AGVs was Volvo, which installed 280 computer-controlled vehicles in their Swedish automobile plant in 1973. This replaced their traditional conveyor assembly line, and was eventually marketed to other manufacturers.

AGVs continued to evolve throughout the 1970s. A new type of AGV that followed UV markers on the floor instead of being towed was implemented at Sears Tower (now Willis Tower) in Chicago for the purpose of delivering mail. In 1975 the first Unit Load (a top load carrier to move goods across a factory floor) was deployed and was able to complete more tasks than any AGV in the past because it came with a work platform, a transportation device and was linked to a computer. In 1979 the first “smart floor” was built into a work space, which used an electric current in the ground to guide the vehicle. This led the way for wires to be completely eliminated by the mid 1980’s.

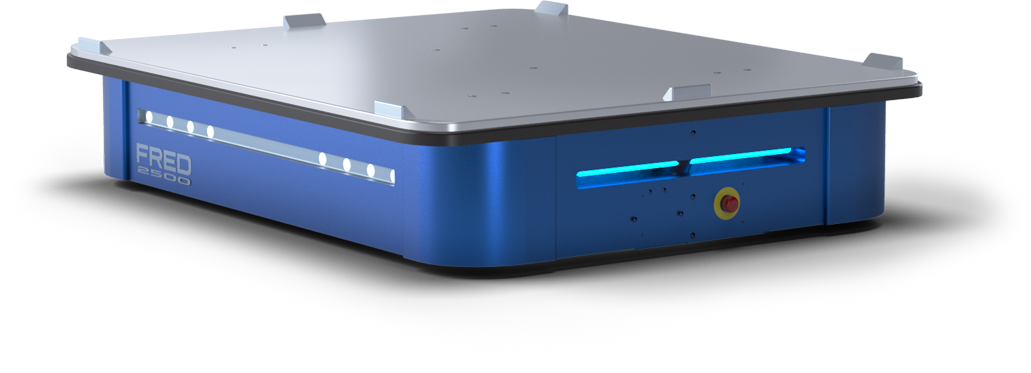

Just as computers are now smaller and more powerful, so are AGVs. They are now an indispensable part of the manufacturing process, and can be found on almost every factory floor. But it’s no longer the Amazons of the world lighting the fuse—it’s small to medium-sized businesses. The incredible ROIs these robots deliver are impossible to ignore. And as AGV technology has grown more sophisticated, the barriers to entry for automation (i.e., the upfront costs), have dropped. You can purchase an AGV like FRED or FREDDiE for $35,000 and $20,000 respectively, without sacrificing any capability. FRED—the heavier-duty model of the two AGVs—carries up to 2,500 lbs and tows up to 5,000 lbs.

By the end of 2015, the global AGV market was valued at just over $800 million and expected to nearly double in size within nine years. But just three years later, its valuation had already eclipsed $1.5 billion. At that time, estimates once again saw the market doubling within nine more years, but the market beat estimates, achieving a valuation of $3 billion by 2019. Today, estimates see the global AGV market hitting a valuation of just over $8.5 billion by 2027. If the trend we’ve witnessed over the past few years is any indication, the market will hit that valuation far sooner as more and more businesses turn to automation to drive their bottom lines. The industries driving this growth are automotive (no pun intended), retail, food & beverage and manufacturing.

As we mentioned earlier, Volvo was one of the first companies to adopt AGV technology. Early on, only the largest auto companies recognized the need for more efficiency through automation. Now, it’s not just the major manufacturers using AGVs for material transport. It’s their suppliers and smaller aftermarket parts manufacturers, too. Suppliers and parts manufacturers have to continuously focus on managing their goods and stock. AGVs streamline their every movement, and free up floor space to improve warehouse storage capacity.

Huge e-commerce players like Amazon catalyzed the exponential growth we’ve recently seen in the AGV market. Now, it’s retail businesses of all sizes driving the growth. From increased globalization to the rising customer demand, retail companies face growing pressure and competition from many directions. AGVs in warehouses and stores can help deal with these issues—especially one like FRED or FREDDiE. Even working just five days per week for two eight-hour shifts each day, its cost comes to just $6.25 per hour over the course of one year. After that, FRED works for free. But the robot can actually work 24/7/365. Essentially, FRED performs over three times the amount of work a human material mover can for less than a third the cost.

As online retailing grows, so too does the ordering of food and beverage products. This new food-delivery paradigm—often direct-to-consumer—puts immense pressure on food and beverage manufacturers. They need to do more than just keep up with demand, they need to optimize their operations to do so in an efficient and timely manner. Many food products are heavily commoditized. To stay competitive, most manufacturers must continuously seek out new ways to increase the cost-effectiveness of their operations. And that’s why food and beverage companies of all sizes are turning to AGVs for help. An AGV significantly reduces incidences of spilled and damaged products. It also allows small to mid-sized companies to make better use of their workforces. Their skilled labor is freed to work in more productive capacities than material movement.

The manufacturing sector as a whole has long embraced AGVs. Whether transporting raw materials or taking finished goods through an EOL (End of Line) process, the automated vehicles offer significant efficiencies humans simply can’t match. But in years past, all but the largest firms tended to shy away from AGV technology. The robots came with high upfront investments and were complex to implement and maintain. Now, AGVs like FRED and FREDDiE are introducing the productivity-enhancing benefits of automation to manufacturers of all sizes and across even more industries.

Large manufacturing plants across all sectors have long used AGVs. Because of newer, smaller and more accessible AGVs like FRED and FREDDiE, the future of AGV usage will mostly come from small- and medium-sized manufacturers. The benefits of AGVs—space savings, cost reductions, worker-injury reductions, fast ROIs and more—are rippling throughout the sector. It’s expected that it will now be the smaller firms that stand to grow the most from the availability of low-cost, low-complexity, high-productivity AGV technology.

Automation Questions?

Businesses across many industries are now turning to automation technologies as powerful solutions to once unforeseeable material-movement challenges. We’re here to help you navigate the automation landscape, and drive your business forward. To learn more about how FRED and FREDDiE provide easy-to-implement solutions to complex challenges, contact an ASI Automation specialist today at info@fredagv.com.

Sources:

https://www.marketsandmarkets.com/Market-Reports/automated-guided-vehicle-market-27462395.html

https://www.grandviewresearch.com/industry-analysis/automated-guided-vehicle-agv-market

https://www.fortunebusinessinsights.com/automated-guided-vehicle-agv-market-101966

https://www.abelwomack.com/study-global-agv-market-to-nearly-double-by-2024/

https://www.businessinsider.com/amazon-has-huge-savings-potential-from-installing-kiva-robots-2014-12